Mutual funds Investment Growing rapidly in these days. People are invest their money in mutual funds instead of investing in fixed deposits, Gold And real Estate. But many people are still confused about what mutual funds are, how they work, and why people consider them a good investment tool.

In this blog we talk about mutual Funds in detail,Mutual Funds Basic, types, Benefits, Risk, Return & how to Start in Beginning.

What Is Mutual Fund

Mutual fund is a pool of money which is collected from multiple investors. Professional Fund Managers Invest this money in Stocks, Bonds, & other securities .

In simple words you invest in Mutual Funds you are hiring experts invest your money on your behalf. Mutual Funds are created for mainly people who don’t have time to track market daily, don’t have deep financial knowledge, don’t want to take individual stock risk & want long-term wealth creation.

How Mutual Funds Works

Investors provide money to Funds managers For invest in Mutual Funds, All investor’s money combined into one large fund. Fund managers invest pooled money to buy stocks, Bonds, or other Securities according to Fund Objective. Based on amount investor invest & Current NAV Investor Receive mutual fund Units. As per investment Value Increase & Decreases, NAV Change. When investors sell their units they make gain & Loss.

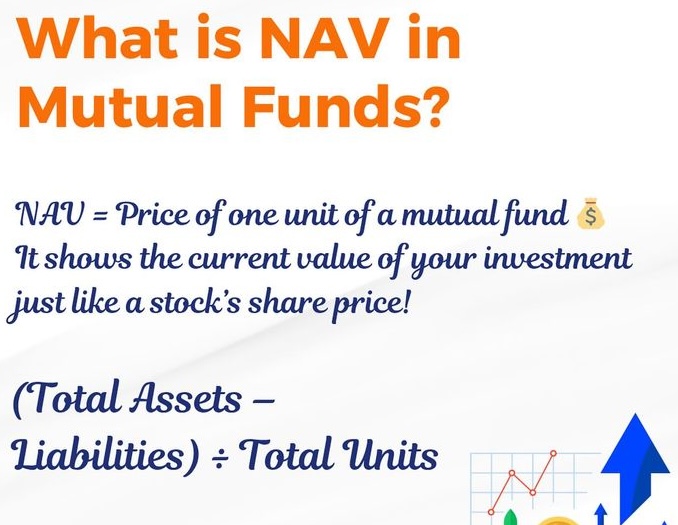

What is NAV

NAV is price of one unit of mutual Funds

Formula NAV = (Total value of Assets – Total liabilities) / total numbers of Units.

When you invest in a mutual fund You Don’t Own AMC, Not Directly Own Shares, You own Units that represents Proportional Ownership Of the Fund’s Assets.

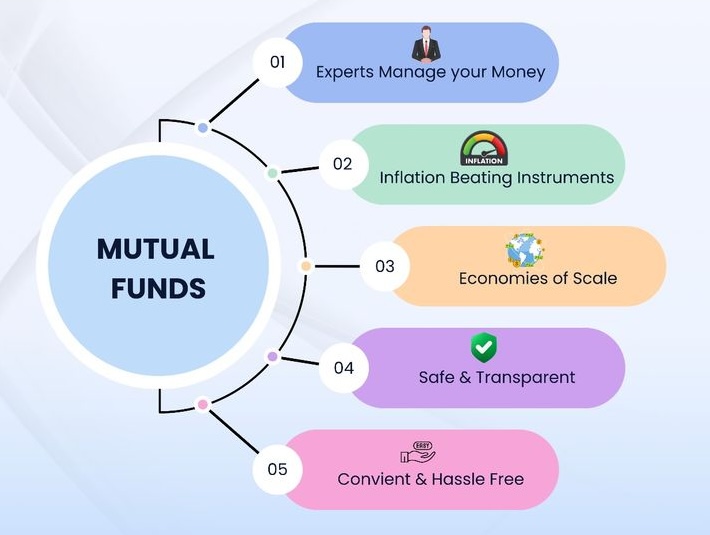

Why Mutual Fund

Before Mutual Funds investing directly in Stocks & Bonds required Deep Financial Knowledge. Large Capital, time To research And Monitors Markets. Most people lake at least one of these.

Types of Mutual Funds

- Equity Mutual Funds

- Debt Mutual Funds

- Hybrid Mutual Funds

- Index Mutual Funds

- ELSS

- And Other

Equity mutual Funds

Fund managers invest money In Stocks. Into this Higher risk, Higher Return Potential & best For long-term Goals.

Market Capitalization

Large Cap Funds Stable With Low Risk. Midcap Funds Higher Growth, Moderate Risk. Small Cap Funds High risk & high return Potential. Large & Mid cap funds Balanced Exposer.

Investment Styles

Flexi Cap Funds Invest across all market caps, Multi Cap Funds Minimum Exposure to Large, Mid & Small caps.Valued Funds undervalued stocks And Other.

Sector Funds

they focus on only one Sector like banking, Pharma, Infra, High Risk in that Dependency in A Sector.

Debt Mutual Fund

Funds Managers invest in Fixed income Instruments Like Bonds & Government Securities.

Low Risk Than Equity, More Stable Returns &suitable for Short To Medium- term goals.

Hybrid Mutual Funds

Fund managers invest in both Equity & Bonds. Balanced Risk & It Suitable For Moderate Investors. Exposure to multiple Asset Classes Reduce risk Compared to Pure Equity Investment.

Index Mutual Fund

Fund Manager track market index Nifty 50 or Sensex or other index. Low risk & No Fund manager Business.

Ells

Invest mainly in equity Offer tax Benefits under Section 80C. 3 year Lock-in in it.

How Mutual Funds Generate Returns

Mainly return comes from capital appreciation Dividends/Interest income.

Way of Invest In Mutual Funds

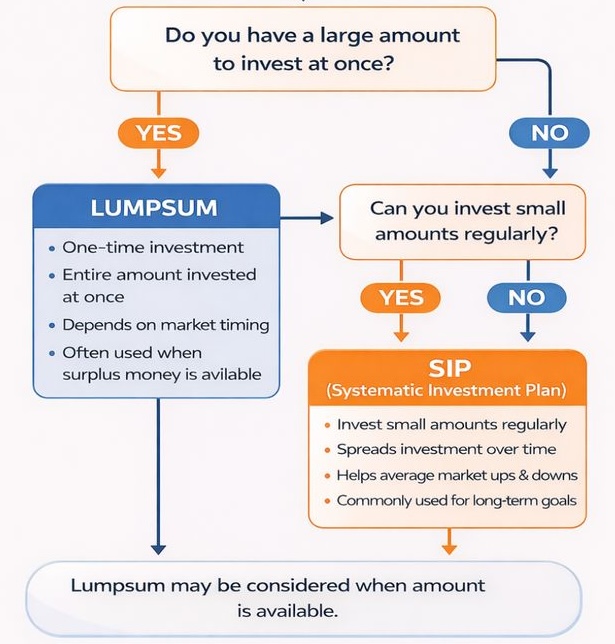

Invest In Mutual Funds By SIP (Systematic Investment Plan)

That means invest a fixed amount regularly (monthly/weekly) in a mutual funds.