What is ETF [ Exchange Traded Funds ]

ETF gives you the security of having a strong amount of money, which reduces your risk. Through ETF, you invest in multiple stocks, which reduces your dependence on any particular stock. If you invest in an ETF, your portfolio keeps growing even if the prices of multiple stocks go down because other stocks cover their returns. Whereas you do not get this safety by investing in particular stocks. By investing in an ETF, you have complete transparency of price as compared to Mutual Funds. In an ETF, you can buy or sell as much as you want, whenever you want. It is a perfect investment tool for long-term wealth creation.

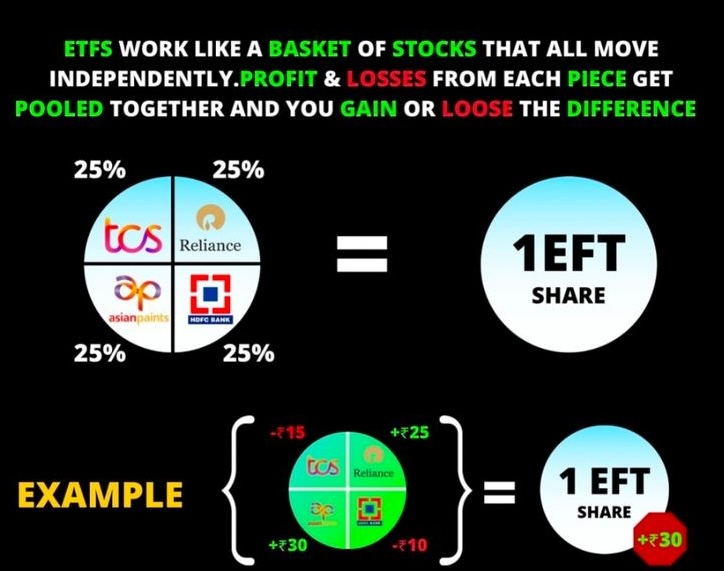

How ETF Works

ETFs replicate index or sector returns (nifty50, Sunsex, Pharma, Banking, etc.) because ETFs invest in stocks in the same proportion as their weightage in the index or sector.

Easy To Buy ETF

Buying stocks requires expertise. This means you need a basic understanding of fundamental and technical analysis of the stock. Investing in ETFs can help you avoid these hassles. Investing is less time-consuming and a safer option.

If the value of the ETF Fund goes down, you can average it. There is no risk in averaging it. In the long term, an ETF will make you profit. If the value of stock goes down, averaging in that case can prove to be risky. We do not know how much the stock can go down and in how much time it will remain stable. You cannot even get an idea of future returns.

You can also invest in gold or silver through ETFs. When you go to the market to buy real gold or silver, you incur manufacturing charges and taxes. When you sell it, you don’t get the real value. The best alternative is to invest in gold or silver ETFs, which will give you a return equal to the return on gold or silver.

Investment Method

you can buy or sell ETFs Like stocks, at any time on market timing. The ETF has good liquidity, so it sells instantly. You can invest in ETFs through both lump-sum and SIP methods. With ETFs, you can properly control your investments, deciding when to invest and when not to invest. You can also invest more or less in ETFs depending on your balance.

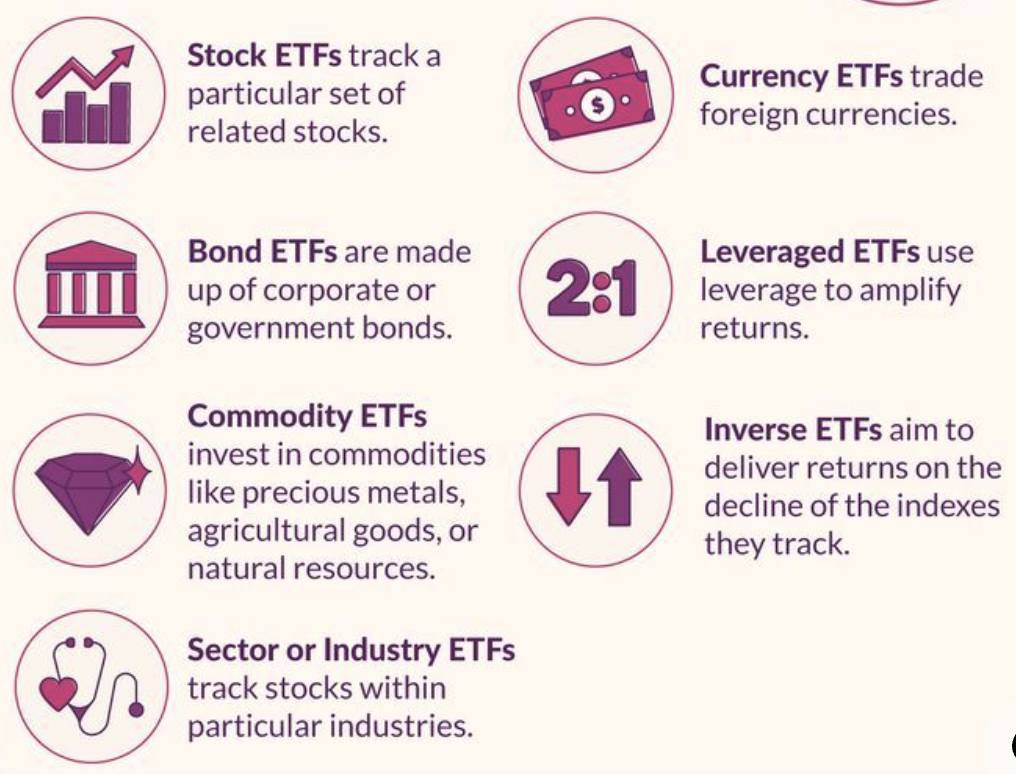

Types of ETF

EQUITY ETFs

Invest in stocks. They can be of any type, such as large-cap, mid-cap, or small-cap. Investors can invest according to their risk tolerance.

DEBT ETFs

Invest in bonds and government securities.

GOLD & SILVER ETFs

you to invest any amount in gold or silver.

INTERNATIONAL ETFs

allow you to invest in international companies.

SECTOR & THEAMATIC ETFs

If you want to invest in a specific sector, choose this type of ETF.

Benefits of ETF Investment

Low Expense Ratio

The biggest advantage is its low expense ratio. These are the charges the fund house incurs annually for managing the ETF. In India, the expense ratio of an ETF ranges from 0.05% to 0.30%, while the expense ratio of mutual funds ranges from 1% to 2%.

Diversification

Investments are made across different asset classes, which results in good returns whether a company is underperforming or performing negatively.

Transparency

We have complete transparency about the buying and selling price. We have complete transparency about which stocks are in the ETF and in what proportion the types are invested.

Conclusion

ETFs are a smart, affordable, and transparent investment option. By choosing the right ETF and investing with a long-term perspective, you can build a strong financial future. If you want market-linked returns at a low cost, ETFs may be an excellent option for you.